About Corporate Investigation Consulting

Dallas, TX

Corporate Investigation Consulting emerges as a seasoned contender in the dynamic and intricate sphere of Anti-Money Laundering (AML) consultancy. With a rich tapestry of experience drawn from a century's worth of federal law enforcement know-how, this company positions itself as a stalwart ally to financial institutions, brokerages, and businesses navigating the turbulent waters of AML compliance.

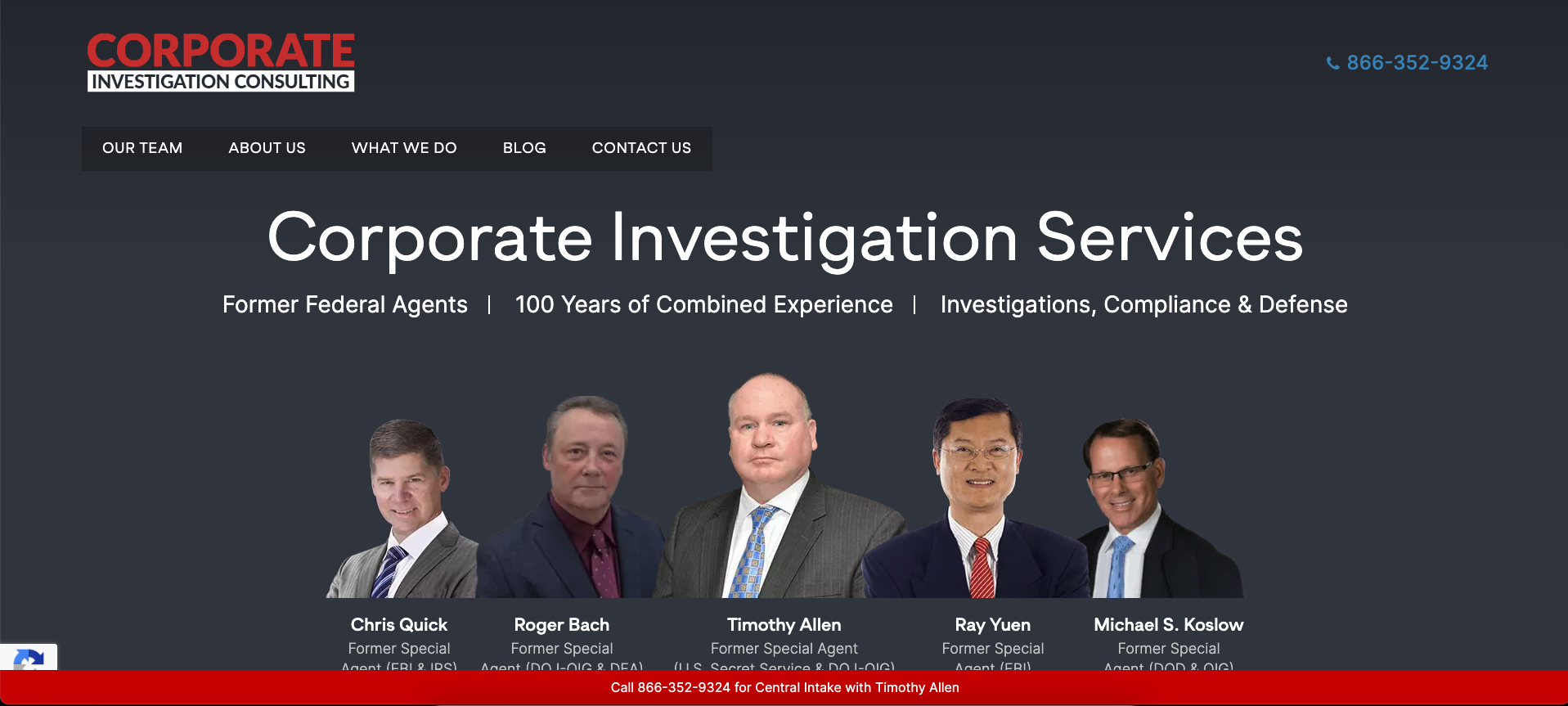

The firm's pedigree is impressive, boasting a team of former high-ranking agents from prestigious agencies such as the U.S. Department of Justice (DOJ), the Federal Bureau of Investigation (FBI), and the Internal Revenue Service (IRS). This deep bench of expertise allows Corporate Investigation Consulting to offer a robust suite of services tailored to an organization's unique AML needs. From policy development to implementation, employee training, and ongoing compliance management, their comprehensive approach is anchored in a profound understanding of the regulatory landscape and the operational challenges businesses face.

In an era where AML compliance is not just a regulatory requisite but a cornerstone for safeguarding institutional integrity, the consultancy's emphasis on customization is particularly valuable. Rather than offering a one-size-fits-all solution, Corporate Investigation Consulting digs into the specifics of each client's risk exposure, operational ethos, and industry demands to craft policies and procedures that are both compliant and congruent with the client's strategic objectives.

Moreover, the firm's services extend beyond the establishment of compliance frameworks to include due diligence, internal auditing, and even assistance during federal AML investigations. This end-to-end coverage signals a proactive stance on compliance, ensuring that clients are not only shielded from potential penalties but are also prepared to demonstrate their commitment to best practices in AML governance.

What sets Corporate Investigation Consulting apart in the crowded field of AML consultancies is its tactical blend of investigative proficiency and legal insight. The company's ability to provide a clear-eyed assessment of AML compliance obligations, coupled with its investigative tactics to prevent or respond to crisis situations, makes it a distinctive force. Its focus on maintaining banking relationships alongside compliance underscores a nuanced appreciation of the financial ecosystem and the interdependencies at play.

Despite these strengths, it's important to note that the AML consulting space is replete with firms offering a myriad of specialized services. While Corporate Investigation Consulting impresses with its law enforcement lineage and comprehensive service offerings, potential clients should consider their specific needs and how they align with the consultancy's strengths. A careful evaluation of how the firm's services match up against those of competitors, especially in areas like technological integration and sector-specific experience, will yield the most informed decision.

In conclusion, Corporate Investigation Consulting stands out for its investigative expertise, tailored approach, and preventative strategies. For businesses seeking a partner with a law enforcement edge and a deep commitment to AML compliance, this consultancy offers a solid alliance. Its focus on providing evidence-based, risk-aligned AML solutions designed to withstand the scrutiny of federal investigations makes it an attractive option for those looking to fortify their defenses against financial crime.

Fast Facts

- Corporate Investigation Consulting boasts 100 years of combined experience in the field.

- The company offers a range of services including compliance services, cyber security investigations, digital forensics, due diligence audits, forensic accounting, internal audit consulting, and risk management audits.

- Corporate Investigation Consulting's team includes former federal agents from agencies like the DOJ, FBI, IRS, and other federal entities.

- Their AML consulting services are aimed at helping institutions and businesses establish and maintain compliance with pertinent federal requirements.

Products and Services

- AML Consulting Services - Consulting services to help banks, brokerages, and other businesses establish and maintain AML compliance with a team of former high-ranking agents from DOJ, FBI, IRS, and other federal agencies.

- Compliance Services - Assistance with implementing policies, procedures, and practices designed to meet federal AML compliance requirements.

- Cyber Security Investigations - Investigative services to protect against cyber threats as part of a comprehensive AML strategy.

- Digital Forensics Investigations - Forensic analysis to uncover digital evidence related to financial crimes and AML concerns.

- Due Diligence Audits - Conducting thorough investigations to ensure client businesses meet AML regulatory standards.

- Forensic Accounting - Accounting expertise to examine financial records for signs of money laundering and other financial crimes.

- Internal Audit Consulting - Expert consulting in internal audits to assess and improve AML compliance programs.

- Risk Management Audits - Evaluations focused on identifying and mitigating AML risks within an organization.

Want to learn more?

Click here to check out the rest of our rankings and reviews.