About AML Partners LLC

Concord, NH

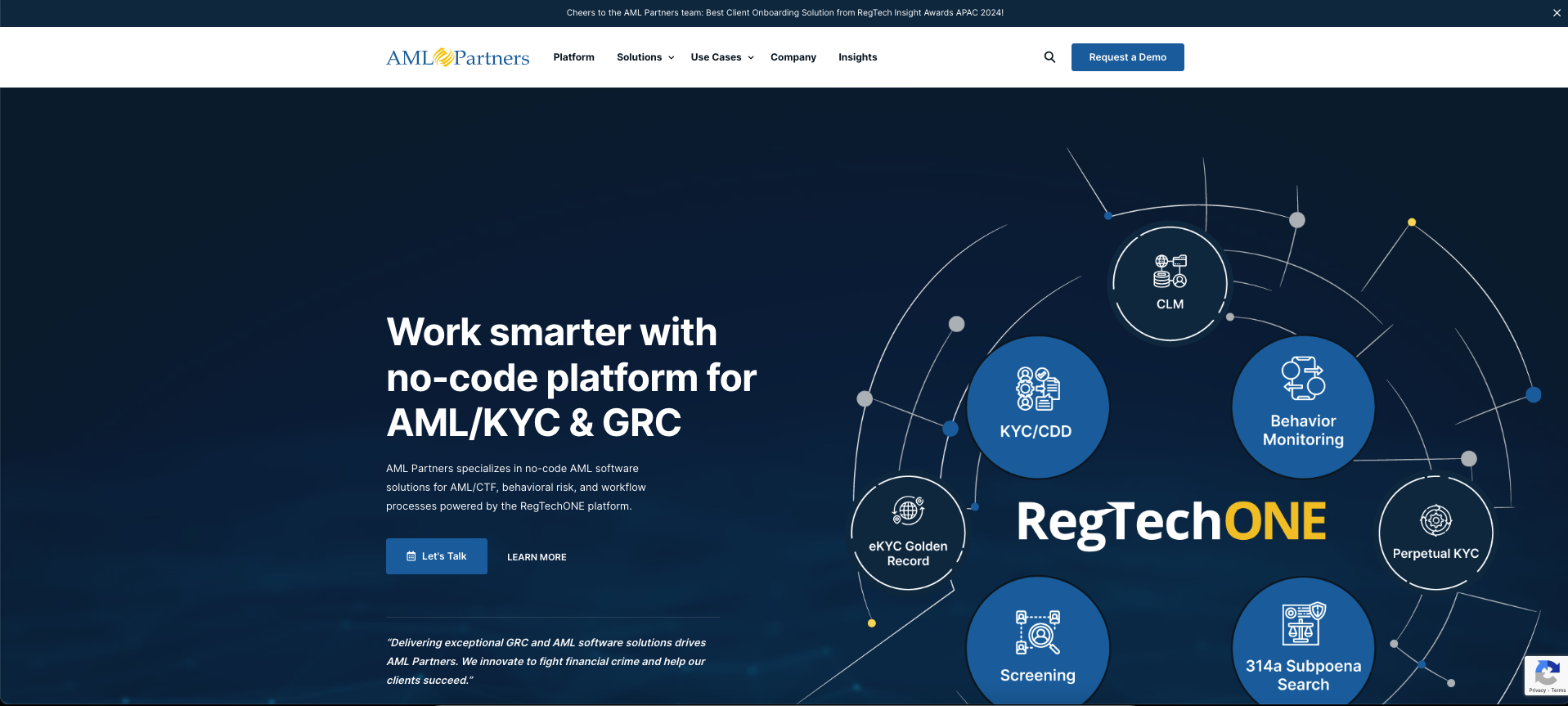

AML Partners LLC stands out in the crowded field of Anti-Money Laundering (AML) consultants with its RegTechONE platform, a testament to their commitment to technological innovation and efficiency in compliance strategies.

In an industry where risk assessment and compliance are paramount, AML Partners LLC promises to deliver automation and streamlined processes without the need for extensive coding knowledge. This offering is particularly attractive to financial institutions seeking to enhance their AML efforts with cutting-edge technology that simplifies and accelerates the compliance process.

The company's approach to AML solutions, which emphasizes ease of use and powerful automation, reflects a clear understanding of the challenges faced by institutions in maintaining compliance in a dynamic regulatory landscape. Their platform is designed to cater to a range of compliance needs, from KYC onboarding software to transaction monitoring and sanctions screening. These tools are critical for companies looking to stay ahead of potential financial crimes and regulatory penalties, and AML Partners LLC’s solutions are presented as both comprehensive and user-friendly.

AML Partners LLC's dedication to customer success is evident in its service offerings, which extend beyond software solutions. They provide a full suite of AML services, including risk assessments, independent reviews, and staff augmentation. This holistic approach to AML compliance ensures that clients not only have access to top-tier technology but also receive support from seasoned professionals who can offer tailored advice and strategies.

One of the key differentiators for AML Partners LLC is their no-code platform, which empowers end-users to configure modules and integration options that align with their specific requirements. This level of customization is crucial in an industry where one-size-fits-all solutions rarely address the unique risk profiles and operational nuances of different institutions.

While the technical jargon associated with AML compliance solutions can be daunting, AML Partners LLC's emphasis on user-friendly design and no-code solutions is a significant advantage. The ability for clients to adapt the platform to their evolving needs without extensive IT intervention is an attractive feature that underscores the company's commitment to flexibility and adaptability.

In terms of customer support, AML Partners LLC boasts a global presence, with strategic partnerships and support associates across various locations. This international reach suggests that they are well-equipped to handle the diverse AML challenges faced by global financial institutions.

In conclusion, AML Partners LLC positions itself as a forward-thinking and customer-centric firm in the AML consultancy space. Their RegTechONE platform is a standout offering that promises to deliver not just compliance, but compliance with efficiency and adaptability. While the proof is in the implementation and long-term effectiveness of their solutions, AML Partners LLC's approach to AML compliance through technological innovation and user empowerment is certainly compelling. For firms seeking a partner that can provide both advanced software solutions and expert consulting services, AML Partners LLC is a worthy contender.

Fast Facts

- AML Partners LLC is recognized as a RegTech100 Company for the year 2024.

- The company's RegTechONE platform eliminates the need for coding to enhance automation and efficiency in compliance.

- AML Partners LLC has strategic and integration partnerships globally to deliver their services.

- AML Partners LLC offers a RegTechONE platform that includes no-code modules for every element of AML Compliance.

Products and Services

- "RegTechONE platform" - A no-code solution designed to enhance automation and efficiency in compliance without the need for coding, catering to institutions that value technological integration.

- "FinCEN 314a / Subpoena Search" - Automates FinCEN 314a and other subpoena searches with configurable queries for data matches according to regulatory requirements, ensuring compliance with legal standards.

- "Risk Data Service" - Provides quarterly updates on geographic risk crucial to AML Risk modeling and management, including country risk ratings and U.S.-specific financial crime data.

- "AML Compliance Solutions" - Offers comprehensive programs tailored to client needs, encompassing end-to-end AML software, KYC solutions, transaction monitoring, and sanctions screening software.

Want to learn more?

Click here to check out the rest of our rankings and reviews.